Great potential in electronic invoicing

Each year, Kredinor handles more than 8 million invoices for various clients through its Fakturaservice invoice follow-up service. The channel by which the customer receives the invoice – and the payment solutions offered have a considerable impact on the payment stream.

“Sending invoices electronically makes a lot of sense. And by electronically, we are talking about channels other than e-mail,” says Jo Fjeldstad, Sales and Concept Manager for Fakturaservice at Kredinor. “It cuts down on the time and money a company spends on administration and issuance costs – and speeds up payment from the customer. The reason is simple. The customer receives their invoice through a channel which makes payment easy, and which they feel comfortable with. In addition, they are notified digitally about the invoice, which is ready for one-click payment,” he explains.

More than 3.4 million people in Norway (around 95 per cent of all active electronic invoice (eFaktura) recipients) have said “Yes to all” and can receive eFaktura invoices from the very start. The same goes for businesses. As many as 170,000 businesses have said yes to invoices in the EHF format, and can be searched for via the Elma register. These companies can receive the invoice and read it straight into their accounting system. This has a major impact on payment time.

Profitable electronic invoicing

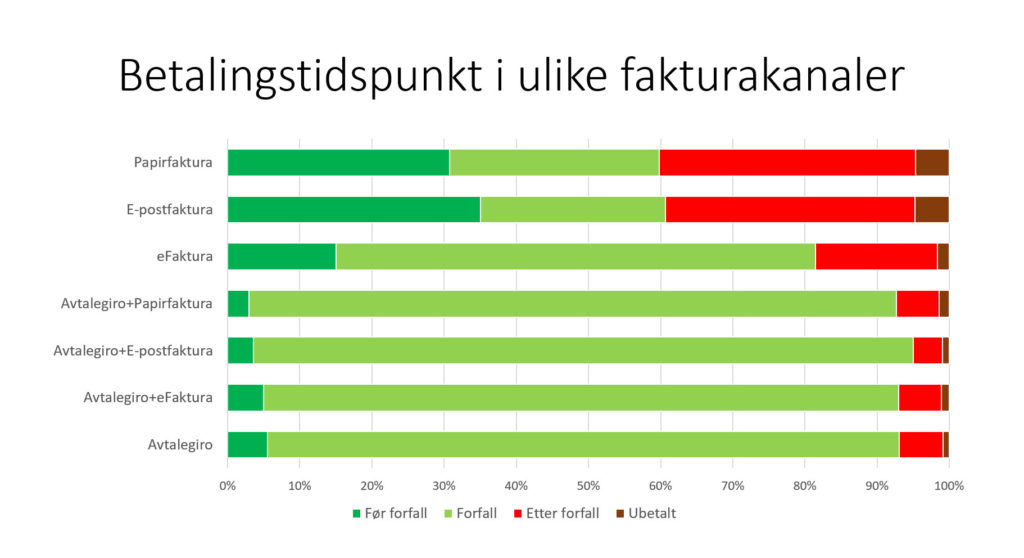

“Our analyses show that an invoice sent electronically directly to the customer’s online bank, in the form of Avtalegiro, eFaktura or Vipps, is paid on average 3–4 days earlier than invoices sent by post or by e-mail. Our figures also show that around 40 per cent of invoices are paid after their due date when they are sent by post. That is why electronic invoicing makes financial sense,” says Jo Fjeldstad.

The graphs show the distribution of payments received before and after the due date from customers of Kredinor’s Fakturaservice clients. Customers with various combinations of direct debit (Avtalegiro) agreements pay by the due date at a much higher rate than those who receive invoices by post or e-mail. This also applies to eFaktura customers. Source: Kredinor

Electronic invoicing results in payment 3–4 days earlier than invoices sent by post or e-mail. Faster payment is good for liquidity.

Avtalegiro, eFaktura or EHF

Direct debit through Avtalegiro is the best channel for secure payment on the due date, but this is not an option for many customers. This is where eFaktura or EHF comes in. “We recommend eFaktura as the first choice for those who have private customers and EHF as the preferred channel for organisations and companies, where Avtalegiro is not an alternative. Offering the customer invoicing and payment via these channels should be a top priority for everyone working with credit,” says Jo Fjeldstad.

Effective notification with Let’s Pay

To increase the chance of fast payment, Kredinor can send a text message (SMS) reminder, with a link to the fully digital payment solution Let’s Pay, a few days after the due date. It is clear that our client is the sender, and the customer can easily pay without entering an account number, amount or CID. “I think customers are pleased to receive a friendly reminder by text message if they forget to pay an invoice by the due date. This often avoids the necessity of issuing a formal debt-collection notice later on,” says Jo Fjeldstad.

Straightforward procedures for registering and updating the customer relationship make a good customer experience and effective customer follow-up even better. Check out these five useful tips.

5 great tips for simplifying customer follow-up and payment

- Enter your customer’s correct name, address, e-mail address and mobile phone number.

- Register the company’s organisation number or the individual’s National ID No.

- Get your customer’s consent to receiving text messages and e-mails from you.

- Choose to invoice your customer electronically.

- Follow up with a text message and payment link on the due date.

Profitable customers through outsourcing

Many people know Kredinor as Norway’s largest debt collection agency. In recent years, we have been contacted by organisations that want help with a larger portion of the payment follow-up process. Many see the value in letting a professional partner, like us, take charge of sales ledger and invoice handling. And for those who also want Kredinor to handle the customer service or call centre function, we will set up a dedicated team to handle customer queries on the client’s behalf.

Integration and cloud solutions connect systems together

We can offer the majority of integrations and Microsoft Azure, an up-to-date, cloud-based infrastructure that makes it easy to connect different systems. While we handle follow-up and reporting, our client has full access to realtime updates on everything they need in their own ERP system. By leaving all this to Kredinor, they reduce their in-house staffing requirement, cut their credit time – and achieve a high level of customer satisfaction.

“When they outsource these functions to Kredinor, our clients are guaranteed that we will provide good customer service, prioritise the digital channels we know the customers want – and offer them the most effective solutions for faster payment,” says Jo Fjeldstad.

Reed more

Contact form Invoicing Services

Enter the information in the fields below. If you have a norwegian org. no the address is entered automatically. *All fields must be filled in.